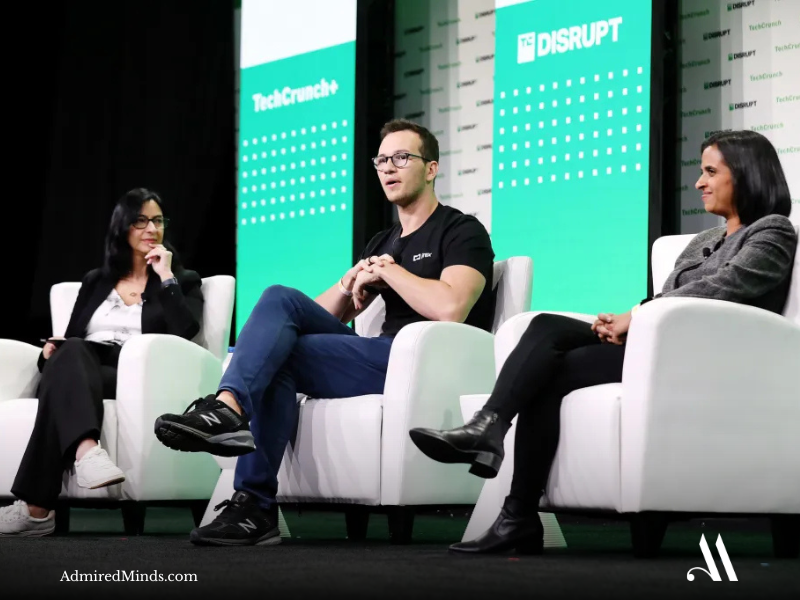

In January 2017, when Henrique Dubugras pitched Brex to Y Combinator partners, traditional banks had dismissed startup banking needs for decades. Established financial institutions required personal guarantees, demanded extensive credit histories, and offered corporate cards with limits so low they couldn’t cover basic operational expenses. But three weeks into Y Combinator’s program, Dubugras made a strategic pivot that would reshape corporate finance: abandoning their original VR startup to build what he called “startup-native banking”¬†based on fundamentally different underwriting models.

That contrarian bet proved transformative. By age 27, Dubugras had built Brex into a company valued at over $12 billion, processing billions in corporate spending while serving tens of thousands of high-growth companies. During the Silicon Valley Bank crisis of 2023, over $3 billion flowed into Brex accounts as startups sought banking alternatives, validating his vision that traditional banking infrastructure couldn’t serve the modern economy.

At 31, Dubugras has demonstrated what he calls “category-native product design”‚Äîbuilding financial services from first principles¬†rather than adapting legacy systems. His recent evolution from corporate cards to a comprehensive spend management platform positions him as a strategic leader who identifies systematic market failures and builds scalable solutions that create new industry standards.

üáßüá∑ From Pagar.me to Silicon Valley: The First-Principles Foundation

The Strategic Pivot: Rethinking Corporate Credit from the Ground Up

Dubugras’ approach to reimagining corporate banking draws from early experiences building financial technology outside traditional systems. At age 16, he co-founded Pagar.me with Pedro Franceschi, creating what became known as “the Stripe of Brazil”¬†and processing $1.5 billion in transaction volume within three years.

His strategic insight emerged from recognizing that existing banking infrastructure was designed for established businesses, not high-growth startups with unique financial profiles. This led to his famous observation:

“Traditional banks looked at startups and saw risk. We saw an entire market segment that was completely underserved by outdated underwriting models.” — Henrique Dubugras

The decision to sell Pagar.me to Stone and move to Stanford revealed sophisticated thinking about global market opportunities. The subsequent three-week pivot during Y Combinator from a VR startup to fintech demonstrated an extreme ability to recognize strategic flaws and make rapid adjustments without losing momentum.

The core innovation was Behavioral Underwriting—predicting startup spending patterns and growth trajectories using data signals different from traditional credit models. This enabled Brex to offer corporate cards without personal guarantees, while maintaining sustainable risk management.

Startup-Native Infrastructure: The Architecture of Modern Spend Management

Behavioral Underwriting and Real-Time Scaling

Dubugras’ approach to corporate banking demonstrates sophisticated understanding of how financial services can be rebuilt for digital-first businesses. His methodology centers on “behavioral underwriting”‚Äîusing startup-specific data patterns to assess creditworthiness and spending needs.

The technical architecture Brex built created an integrated system where cards, spending controls, expense tracking, and financial reporting operate as unified infrastructure, moving beyond fragmented legacy solutions. Brex’s strategic layers for startup banking include:

- Intelligent Underwriting: Evaluating companies based on growth metrics and cash flow, not just traditional credit history.

- Dynamic Spending Limits: Limits that adjust automatically based on fundraising and revenue patterns in real-time.

- Built-in Expense Management: Automated integration that eliminates manual processes for growing teams.

The outcome is remarkable: Brex provides 10-20x higher spending limits than traditional cards while maintaining no personal guarantee requirements, creating sustainable unit economics through transaction-based revenue.

Crisis Leadership: Building Trust During the SVB Collapse

Ecosystem Stewardship in Financial System Disruptions

Dubugras’ leadership during the Silicon Valley Bank (SVB) crisis reveals sophisticated crisis management that balanced immediate customer needs with long-term strategic positioning. His primary focus was on providing stability for the startup ecosystem¬†during systemic disruption, rather than capitalizing purely on a competitive opportunity.

The response to the sudden influx of $3 billion demonstrated operational excellence under extreme pressure. Brex managed unprecedented deposit growth while maintaining service quality, proving that startup-focused financial infrastructure could be a source of stability.

His framework for crisis response involves what he calls “ecosystem stewardship”‚Äîmaking decisions that strengthen the entire startup community. This transparent, community-first approach builds long-term trust, which is invaluable for a financial institution.

The Future Vision: An Intelligent Financial Operating System

Beyond Corporate Cards: Strategic Evolution to Intelligent Spend Management

Dubugras’ current strategic focus involves evolving Brex from corporate cards into a comprehensive financial operating system for growing companies. His vision centers on “intelligent spend management”‚Äîusing data analytics to help companies optimize their financial operations rather than just process transactions.

The platform expansion into cash management, bill payments, travel booking, and automated accounting demonstrates strategic thinking about startup financial workflows. Brex is building integrated capabilities that eliminate friction across the entire corporate finance function. Brex now offers:

- Business banking and cards.

- Bill pay and travel booking.

- Automated reimbursements in one scalable solution.

Looking ahead, Dubugras identifies three key strategic opportunities:

- Integration of Artificial Intelligence into spend optimization and fraud prevention.

- Development of automated financial controls that scale seamlessly with company growth.

- Creation of analytics tools that provide real-time performance insights through spending patterns.

Brex’s Strategic Blueprint: Four Pillars of Fintech Innovation

Four Strategic Frameworks for Fintech Innovation Leadership

- Category-Native Product Design: Building financial services from first principles for a specific market (startups) rather than adapting legacy systems.

- Behavioral Underwriting Strategy: Using industry-specific data (growth metrics) to assess creditworthiness, enabling service to underserved, high-potential markets.

- Ecosystem Stewardship Leadership: Making strategic decisions that strengthen the entire industry ecosystem, building long-term trust and stability.

- Intelligent Integration Architecture: Designing platform capabilities that eliminate workflow friction by integrating multiple business functions (banking, cards, bill pay, travel) into seamless user experiences.

***

Want to build a business that scales without being held back by legacy finance? Learn how to apply first-principles thinking to your product design. Discover the Brex approach to spend management today.

***

‚ÄúDon’t just improve existing solutions‚Äîask whether the fundamental assumptions still make sense. The biggest opportunities come from rebuilding systems that everyone assumes are good enough but actually create systematic problems for entire market segments.‚Äù

— Henrique Dubugras

Leave a comment