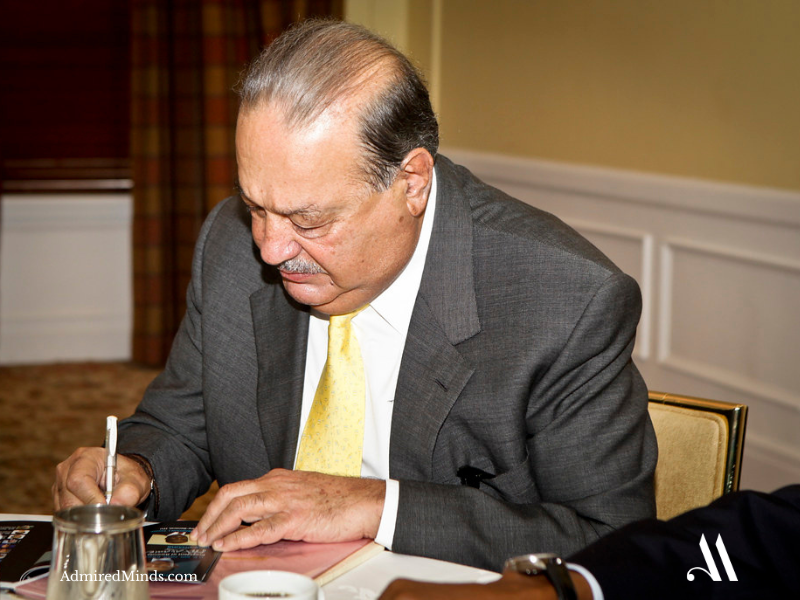

While other billionaires chase headlines, Carlos Slim quietly builds generational wealth. Over five decades, Mexico’s richest man transformed economic disasters into strategic advantages, proving that patient capital and contrarian thinking¬†create more sustainable fortunes than flashy investments.

At 85, Slim controls a business empire spanning telecommunications, construction, mining, retail, and energy. His $93 billion net worth reflects more than accumulated wealth—it represents the compound returns of a strategic philosophy that few executives have the discipline to execute.

Strategic Signature: Crisis Investing That Redefined Contrarian Strategy

Slim’s defining strategic breakthrough came during Mexico’s 1982 debt crisis, when most investors fled emerging markets. While competitors retreated to safety, Slim doubled down¬†on distressed Mexican assets. His contrarian bet on national economic recovery generated returns that established Grupo Carso as Latin America’s dominant conglomerate.

The methodology was deceptively simple: find relatively healthy companies that were undervalued based on overly negative sentiment during economic downturns. This approach required three critical capabilities most investors lack:

- Massive cash reserves.

- Patient capital.

- Emotional discipline during market panic.

His acquisition of Telmex¬†during Mexico’s privatization exemplifies this strategy. While international telecoms focused on developed markets, Slim recognized that Mexico’s growing middle class would drive explosive demand for telecommunications services. The investment generated multi-billion dollar returns and established his reputation for identifying transformational opportunities during crisis periods.

The 36-Year Dividend Strategy

Slim’s most controversial business decision reveals his commitment to long-term value creation. He refused to pay dividends for 36 years straight, believing “the best investment you can make is in your own companies.”¬†While other business owners extracted profits, Slim reinvested everything.

This capital allocation strategy compounded returns that external investors could never achieve. Every peso stayed within the Grupo Carso ecosystem, funding acquisitions, infrastructure development, and vertical integration that created sustainable competitive moats.

Critics called it selfish. Slim called it strategic discipline.

Leadership Philosophy: Patience Over Performance Metrics

Slim’s investment philosophy emphasizes the importance of a long-term vision and patience. He often invests in undervalued companies and waits for them to realize their potential. This approach contrasts sharply with the quarterly earnings pressure that dominates public market thinking. His strategic framework operates on fundamental principles:

- Cash reserves provide strategic optionality: Slim prefers substantial cash reserves, providing liquidity to seize investment opportunities and navigate economic downturns without high debt pressure.

- Diversification across essential services: Rather than chasing high-growth sectors, Slim focuses on industries people need regardless of economic conditions: telecommunications, banking, retail, construction, and energy.

- Operational control over financial engineering: He builds wealth through *operational improvements* (buying a business and retaining it for its cash flow) rather than leverage or market timing.

Business Impact: Building Mexico’s Economic Infrastructure

Slim’s influence extends far beyond Grupo Carso’s financial performance. His strategic investments literally built Mexico’s modern economic infrastructure, creating millions of jobs and establishing platforms for national economic development.

The telecommunications revolution demonstrates this impact. Through América Móvil, Slim connected hundreds of millions of Latin Americans to global communications networks. Current strategic initiatives continue this pattern: Grupo Carso announced approximately $800 million in investments for 2025 across key sectors.

Strategic Innovation: The Conglomerate Model Renaissance

While Wall Street dismantled conglomerates for decades, Slim proved that diversified holdings create strategic advantages in emerging markets. His integrated approach generates synergies that specialized companies cannot achieve:

- Market intelligence advantages: Operating across diverse sectors provides comprehensive economic visibility that informs strategic decisions.

- Capital allocation flexibility: Strong cash flows from defensive businesses fund aggressive growth investments.

- Political relationship management: Diversified operations create stakeholder value across multiple economic sectors, facilitating regulatory approvals and infrastructure partnerships.

Crisis Leadership: Turning Economic Disasters Into Strategic Advantages

Slim’s response to economic crises reveals strategic thinking that creates competitive advantages during market disruption. Rather than defensive positioning, he uses volatility to accelerate market share gains and acquire strategic assets at discounted prices. The 1994 Mexican peso crisis demonstrates this approach: Slim navigated the crisis by restructuring debt and continuing to invest¬†in undervalued assets while competitors struggled.

His crisis management philosophy emphasizes preparation over reaction. Maintaining substantial cash reserves and conservative debt levels provides the strategic flexibility needed to act aggressively when opportunities emerge and competitors face capital constraints.

Energy Strategy: Positioning for Mexico’s Resource Renaissance

Slim’s recent energy investments reflect his long-term strategic vision. In July, he vowed to invest $1.2 billion to develop the Lakach offshore gas field. This strategic positioning anticipates Mexico’s energy transition, recognizing that natural gas provides essential bridge fuel for economic development in emerging markets.

Global Vision & The Slim Strategic Legacy

Although Slim continues business activities, his primary focus is now on education and philanthropic initiatives that develop human capital across Latin America through the Fundación Carlos Slim. This approach generates long-term returns through improved operating environments while creating positive social impact.

Carlos Slim proved that contrarian investing and patient capital create superior long-term returns compared to momentum strategies and financial engineering. His 50-year track record demonstrates how strategic discipline during crisis periods generates compound returns that dwarf conventional investment approaches.

Ready to apply Slim’s principles to your own financial life? Start by analyzing your long-term goals and identifying opportunities others are overlooking.

***

‚ÄúAnyone who is not investing now is missing a tremendous opportunity… I learned from my father that you continue to invest and reinvest in your business ‚Äì including during crises.‚Äù

— Carlos Slim Helú

Leave a comment