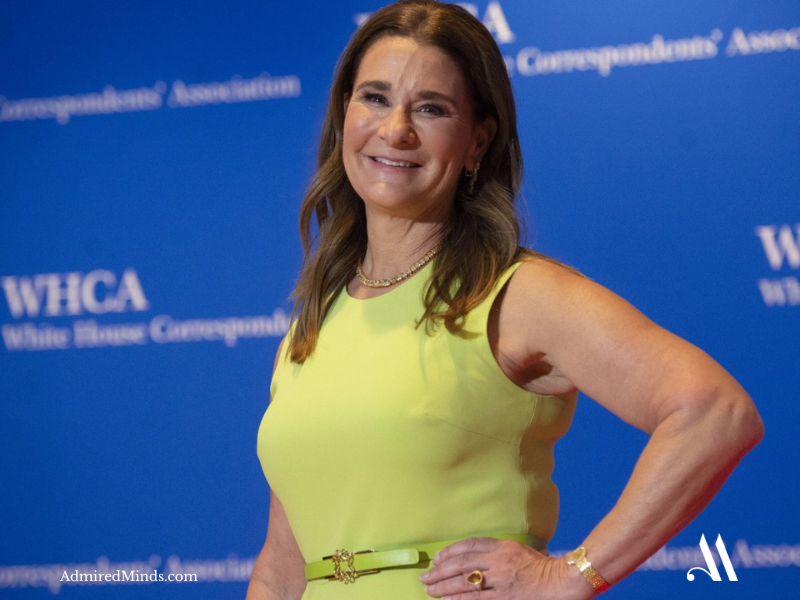

The Strategist Who Made Gender Equity a High-Return Investment Thesis

When Melinda French Gates announced her departure from the Bill & Melinda Gates Foundation in 2024, institutional investors paid close attention. Not because of foundation politics, but because French Gates had already proven something revolutionary‚ that investing in women is not charity. It is one of the highest-return investment strategies of the modern era.

“When we invest in women and girls, we invest in a future that benefits everyone.”

At 60, French Gates controls one of the most sophisticated global investment blueprints centered on women’s economic empowerment. Her $1 billion commitment through 2026 represents the largest structured effort to prove that gender lens investing outperforms traditional asset allocation approaches.

Strategic Signature: Transforming Philanthropy Into Performance Investing

Her defining breakthrough came with the creation of Pivotal Ventures in 2019. Where traditional philanthropy viewed women’s issues as charitable causes, French Gates reframed them as market inefficiencies and untapped economic engines.

By investing directly in women-led companies and funds, Pivotal Ventures challenged the long-established norms of venture capital, which historically excluded female founders from systematic capital access.

“This is not charity. This is smart investing.”

This is not a side project‚ it is a structural challenge to the financial industry, proving that gender-diverse companies deliver stronger profitability, stronger innovation, and stronger crisis resilience.

The Data-Driven Revolution

French Gates’s investment philosophy centers around measurable results. She insists that gender equity investing should meet or exceed traditional performance benchmarks.

The strategic framework operates through three integrated approaches:

Direct investments. Supporting women-led startups and scale-stage companies.

Fund-of-funds strategy. Building an ecosystem of women-led VC and PE funds.

Infrastructure building. Deploying capital to remove systemic barriers preventing women from thriving professionally.

Leadership Philosophy: Economic Empowerment as Strategic Imperative

French Gates champions a core principle: when women thrive economically, societies and markets rise with them.

Her strategic approach is built on three market truths:

Capital allocation bias creates opportunity. The long-standing underinvestment in women-led companies becomes a high-yield frontier for disciplined investors.

Diverse leadership outperforms. Companies with gender-balanced teams show stronger profitability, innovation, and risk management.

Stakeholder capitalism drives competitive advantage. Businesses that invest in women’s wellbeing and advancement retain top talent and outperform over time.

Business Impact: Redefining Venture Capital Standards

French Gates’ influence extends far beyond her portfolio. She has pushed institutional investors worldwide to adopt new evaluation methods centered on gender-equity outcomes.

For example, women’s workforce participation in the U.S. fell from 84% to 80.9% between 2022 and 2024, a systemic inefficiency her strategy directly targets through investments in caregiving, workplace redesign, and flexibility.

Strategic Innovation: The Gender Lens Investment Framework

Her most transformative innovation has been developing measurement systems that prove gender lens investments deliver superior returns. These frameworks allow major investors to integrate gender-equity strategies while maintaining fiduciary responsibility.

The investment architecture prioritizes:

Technology solutions for women. Companies addressing health, finance, workplace, and consumer barriers faced by women.

Scalable gender-impact models. Ventures where women’s empowerment is aligned with high-growth business strategies.

Infrastructure for women’s success. Systems-level investments supporting economic mobility and leadership access.

Crisis Leadership: Turning Setbacks into Opportunity

In moments of policy regression affecting women, French Gates didn’t slow down‚ she accelerated investment. Pivotal Ventures expanded funding across reproductive rights, caregiving, and workplace equality.

“When the moment grows harder, our commitment must grow stronger.”

This resilience demonstrates her ability to convert policy volatility into strategic advantage. When markets overlook women’s needs, French Gates invests where the competition is scarce and the return potential is massive.

Global Vision: Exporting Gender Lens Investing Worldwide

French Gates’ ambition extends across continents. Her investments recognize that women’s empowerment creates economic multiplier effects across generations.

Recent global initiatives include:

Health and caregiving infrastructure. $100 million committed to women’s health research and delivery systems.

Economic participation acceleration. Policy and business innovations enabling women to enter or re-enter the workforce.

Next-generation leadership development. Programs supporting women’s advancement in business, technology, and public leadership.

Why French Gates Redefined Strategic Leadership

French Gates proved that gender equity is not a moral obligation alone‚ it is a competitive edge. She demonstrated that performance investing and social impact are not contradictory but mutually reinforcing.

She recognized that demographic shifts, purchasing power, and generational transitions are re-shaping global markets‚ and positioned her strategy ahead of the curve.

The French Gates Strategic Legacy

Since leaving the Gates Foundation, she has authored another book and committed an additional $1 billion to advancing women’s power globally. These efforts strengthen entire economic ecosystems, not just individual companies.

Her framework shows that gender lens investing is not niche‚ it is foundational to navigating emerging global economic realities. As women control more wealth and consumer spending, businesses that understand these dynamics will lead the next economic era.

Leave a comment