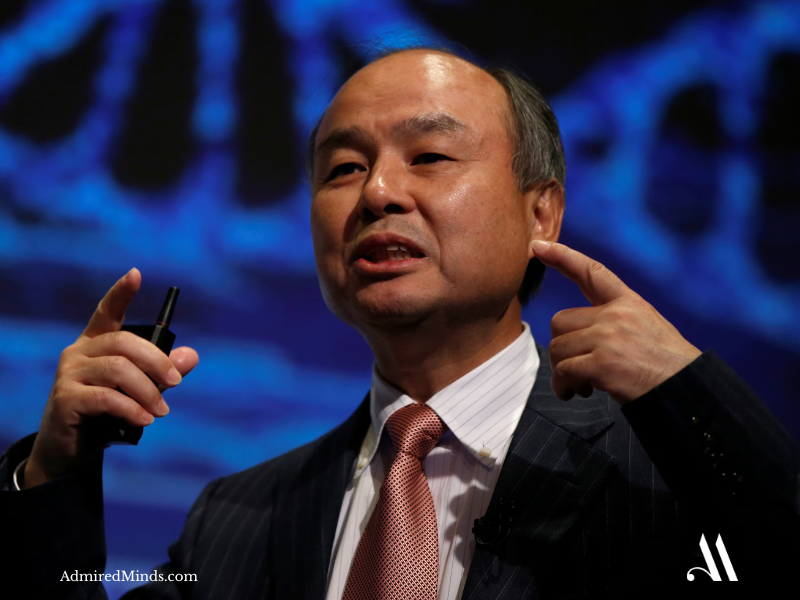

The Visionary Who Bets Centuries on Artificial Superintelligence

When Masayoshi Son speaks about the future, tech executives listen with skeptical fascination. Not because of SoftBank’s $98 billion market cap, but because Son thinks in time horizons that make other CEOs uncomfortable. His 300-year corporate vision and $100 billion Vision Fund represent the most audacious attempt to reshape humanity’s technological trajectory.

“I was born to realize ASI.”

At 67, Son has transformed SoftBank from a Japanese software distributor into the world’s most aggressive technology investor. His current obsession with artificial superintelligence isn’t just another investment thesis‚Äîit is his life’s purpose.

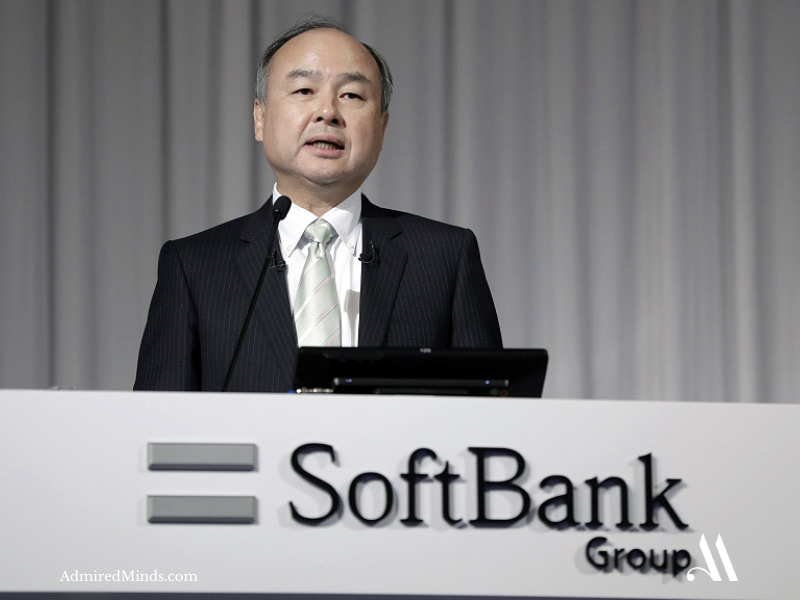

Strategic Signature: The $100 Billion Bet on Human Evolution

Son’s defining strategic breakthrough came with the Vision Fund’s creation in 2017. While other investors deployed millions, Son raised $100 billion to systematically identify and fund technologies that would define the next century of human development.

The methodology defied conventional venture capital wisdom. Instead of diversification, Son concentrated massive capital into category-defining companies. His investments in Uber, WeWork, and other unicorns were not simply financial plays‚Äîthey were foundational pieces of what he calls the “Information Revolution.”

“If you’re going to do something, be bold. Be the first. Be the best.”

Critics called it reckless. Son calls it inevitable preparation for artificial superintelligence.

His latest strategic pivot reflects this conviction—SoftBank Vision Fund reduced its workforce by 20% to focus entirely on AI-driven investments. In 2024, Son declared SoftBank was done with its dormant phase and would launch an aggressive AI offensive.

The 300-Year Philosophy

Son’s most controversial business principle involves thinking beyond human lifespans. He wants SoftBank to be built with DNA capable of surviving 300 years. This time horizon shapes investment decisions that appear irrational to short-term competitors.

‚ÄúIn 300 years’ time, we want to become the company that makes the greatest contribution to human evolution.‚Äù

This philosophy creates competitive advantage through patient capital, contrarian timing, and long-term positioning in technologies that may not mature for decades.

Leadership Philosophy: Information Revolution as Human Purpose

SoftBank’s corporate identity—“Information Revolution: Happiness for Everyone”—drives Son’s strategic framework. He views technology as the primary force shaping civilization and positions SoftBank as a catalyst for that transformation.

His strategic mindset operates on three core principles:

Exponential thinking over linear projections. Son invests in technologies capable of 10x leaps, not incremental improvements.

Market creation over market share. He funds companies that create entirely new sectors rather than battle in old ones.

Conviction over consensus. Massive bets are placed on intuition, vision, and conviction—not market validation.

Business Impact: Redefining Venture Capital at Scale

Son’s Vision Fund model revolutionized global venture capital. Deploying over $100 billion across 88+ companies, he created the largest technology investment vehicle in history.

Portfolio companies employ millions worldwide and collectively represent hundreds of billions in market value.

More importantly, Son accelerated global technology adoption by injecting enormous capital into companies long before traditional investors would.

Today, SoftBank invests in Graphcore, Ampere Computing, Intel, Nvidia, and is reportedly preparing a $25 billion investment in OpenAI.

Strategic Innovation: The Artificial Superintelligence Thesis

Son predicts ASI—10,000× smarter than humans—within 10 years. This belief shapes every strategic move within SoftBank.

AI infrastructure investments. Tripling its Nvidia stake and expanding into semiconductor and compute infrastructure.

Organizational restructuring. A 20% Vision Fund workforce reduction to focus exclusively on AI.

Partnership-driven ASI development. Rather than building its own AI, SoftBank funds global breakthroughs.

Crisis Leadership: Turning Market Volatility Into Strategic Advantage

Son’s response to early Vision Fund hits‚Äîsuch as WeWork‚Äîwasn’t retreat but recalibration. SoftBank sold or wrote down $29 billion in assets while doubling down on AI.

“Failure is not falling down, but refusing to get up.”

This resilience created long-term credibility and strengthened SoftBank’s investor base.

Global Vision: Becoming Humanity’s Technology Partner

Son believes technological progress requires global collaboration. SoftBank operates across Asia, the Americas, and Europe to identify breakthrough innovators.

His global strategy focuses on:

AI talent acquisition — funding top researchers worldwide.

Infrastructure development — semiconductors, computing, and telecom.

Regulatory influence — shaping global AI policy.

The Son Strategic Legacy

Son believes AI may surpass human intelligence by 10,000√ó by 2035. Whether this occurs or not, Son has already changed how breakthrough technologies are financed.

His Vision Fund model proves that conviction-based, large-scale investment can accelerate civilization-level changes.

Why Son Redefined Strategic Leadership

Masayoshi Son demonstrates that true visionary leadership requires courage to pursue ideas beyond conventional risk frameworks. His willingness to bet billions on artificial superintelligence reflects rare strategic conviction.

“Think big. Think long. Think boldly. That is how you change the world.”

Son’s impact extends beyond financial markets. He is shaping the very foundations of humanity’s technological future.

Leave a comment