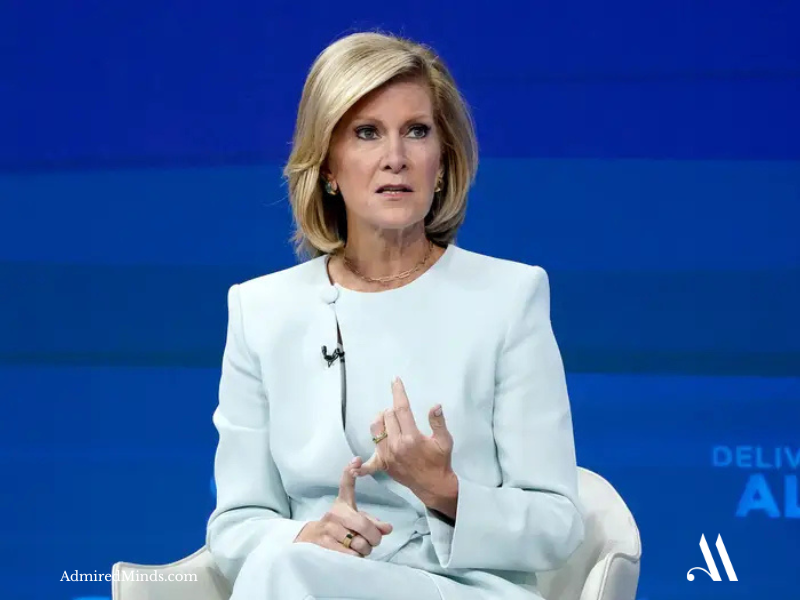

The Strategist Who Built Finance’s Most Powerful Investment Management Machine

When Mary Callahan Erdoes became CEO of J.P. Morgan Asset & Wealth Management in 2009 during the depths of the financial crisis, critics questioned whether anyone could rebuild institutional investor confidence in Wall Street. Sixteen years later, she has transformed the division into the world’s dominant institutional investment powerhouse with $6.4 trillion in client assets and an industry-leading 34% return on equity.

“Great leaders don’t wait for stability — they build systems that thrive in volatility.”

At 57, Erdoes has emerged as finance’s most influential woman, leading more than 30,000 employees with 15 direct reports while positioning J.P. Morgan as the definitive choice for institutional capital allocation worldwide. Her strategic vision to reach $10 trillion in assets under management represents the most ambitious growth plan in institutional investment history.

Strategic Signature: Performance-Driven Institutional Dominance

Erdoes’ defining strategic breakthrough came when she recognized that institutional investors demand both superior returns and operational excellence at unprecedented scale. Since joining the firm in 1996 as a fixed income portfolio manager, she systematically built competitive advantages that competitors struggle to replicate.

Her market-leading performance spans asset classes with 90% of assets for multi-asset solutions and alternatives, 84% for equity and 77% for fixed income ranked in the top two quartiles over 10-year periods. This validates that disciplined investment processes generate superior risk-adjusted returns when executed with institutional rigor.

“In institutional finance, excellence is not an outcome — it is a system you build and protect.”

The strategic genius lies in combining exceptional talent retention with cutting-edge technology infrastructure, creating compound competitive advantages that strengthen over time rather than diminishing through market cycles.

The Elite Talent Strategy

Erdoes’ most revolutionary principle involves treating top investment professionals as strategic assets requiring systematic retention and development programs. Maintaining a 95+% retention rate of top-performing investment team heads, portfolio managers and research analysts creates institutional memory and client continuity that startup competitors cannot achieve.

This strategic framework operates through integrated talent management approaches:

Compensation as a strategic investment. Paying premium compensation to elite performers generates superior client returns that justify higher fee structures.

Technology as a talent multiplier. Cutting-edge systems amplify the impact of elite professionals while reducing inefficiencies.

Relationship-driven client service. Deep partnerships with institutional clients generate long-term, high-trust revenue streams.

Leadership Philosophy: Fiduciary Excellence as Competitive Strategy

Erdoes recognizes that J.P. Morgan’s 200-year-old fiduciary legacy provides competitive advantages that require constant reinforcement through superior performance and ethical leadership. Her worldview challenges industry orthodoxy:

Long-term relationships over short-term gains.

Global scale as a service advantage.

Accountability across all asset classes.

Business Impact: Transforming Institutional Investment Standards

Erdoes’ influence extends far beyond J.P. Morgan’s metrics to redefining how institutional investors evaluate asset managers. Her leadership revived confidence in active management, proving that scale, expertise, and disciplined processes can outperform passive strategies when executed with precision.

The division ended 2022 ranked #2 in global active ETF AUM, driven by flagship strategies like JEPI and JPST, reaffirming their ability to innovate across evolving asset classes.

“In institutions, trust compounds faster than capital — and collapses twice as quickly when ignored.”

Her approach shows that institutions willingly pay premium fees for consistent outperformance and comprehensive capability — benefits that passive strategies cannot replicate.

Strategic Innovation: The $10 Trillion Vision

Erdoes’ bold strategy to scale toward $10 trillion AUM involves record investment in technology, talent, and alternative assets. This requires operational excellence across all markets simultaneously.

Key competitive pillars:

Technology infrastructure. Systems built for massive scale without compromising personalization.

Global expansion. Combining local expertise with worldwide institutional resources.

Alternative asset leadership. Providing diversification beyond public markets.

Crisis Leadership: Financial Crisis Recovery and Growth

Taking control of the division in 2009 demonstrated Erdoes’ crisis leadership. She doubled down on transparency, communication, and continued investment while the industry cut costs.

This discipline allowed J.P. Morgan to capture market share and cement itself as the safest institutional choice.

Global Vision: Institutional Leadership Worldwide

Erdoes recognizes that multinational institutions require seamless investment management across currencies, regulations, and time zones. Recent initiatives include:

Emerging market capabilities.

ESG integration across all strategies.

Global technology integration.

“Scale isn’t power. Scaled excellence is.”

Why Erdoes Redefined Strategic Leadership

Erdoes proved that institutional excellence requires synchronizing talent, technology, and global capabilities. She demonstrated that fiduciary responsibility and commercial success are not competing priorities — they are mutually reinforcing pillars.

The Erdoes Strategic Legacy

Her transformation of J.P. Morgan Asset & Wealth Management from crisis-era uncertainty into global dominance stands as one of the strongest long-term leadership case studies in modern finance.

In a world where institutions demand both returns and comprehensive strategic support, Erdoes’ model proves that scale, talent, and disciplined execution create competitive advantages impossible to imitate.

Leave a comment